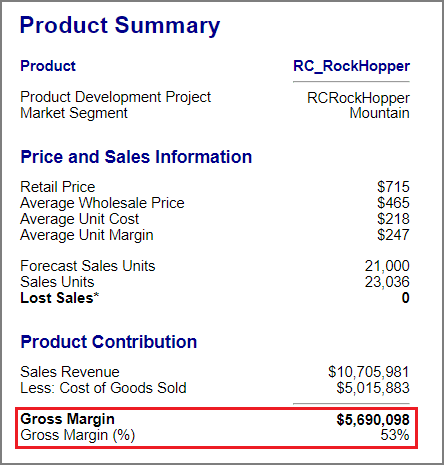

Product contribution margin

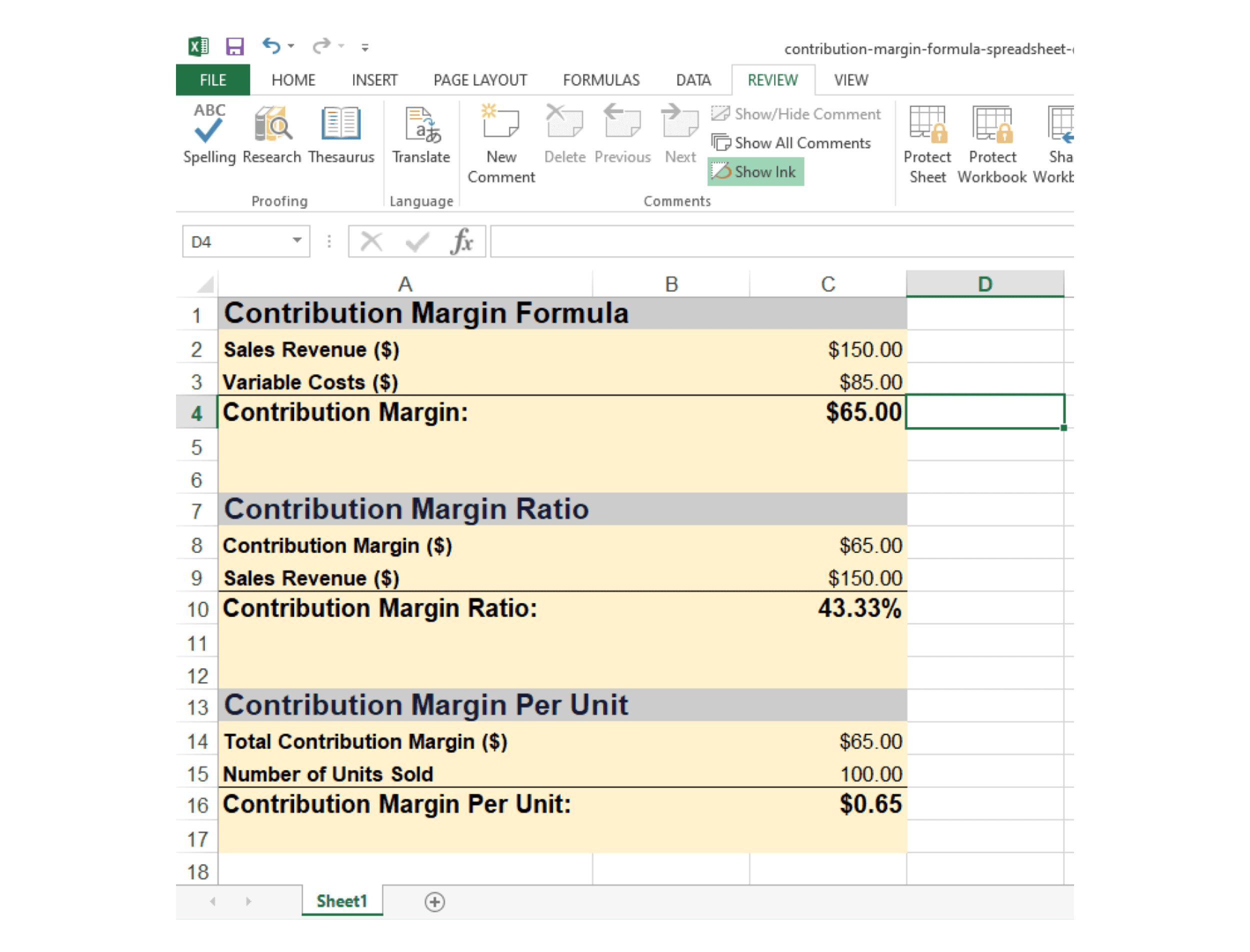

Variable costs are 300 per product thus the contribution margin is 700 or 70 per product. To calculate the contribution margin ratio divide the contribution margin by sales.

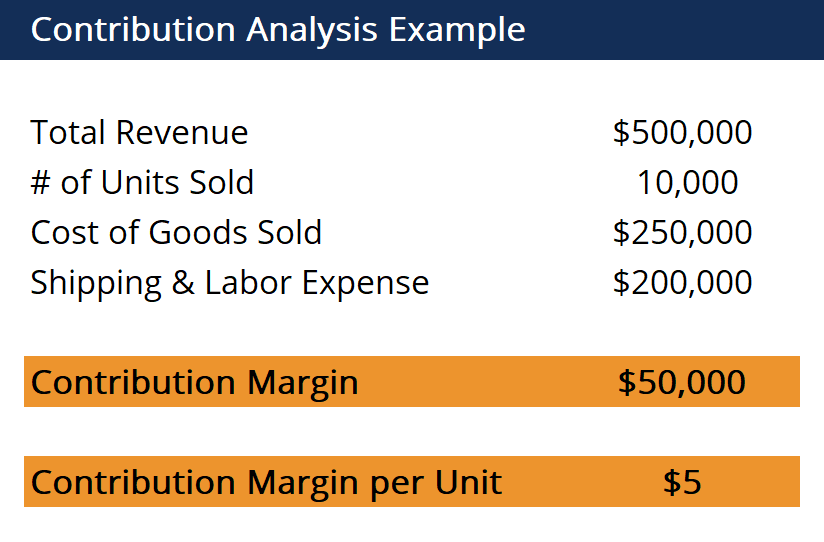

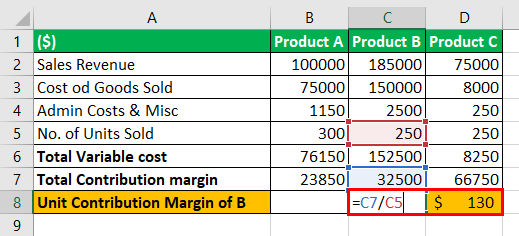

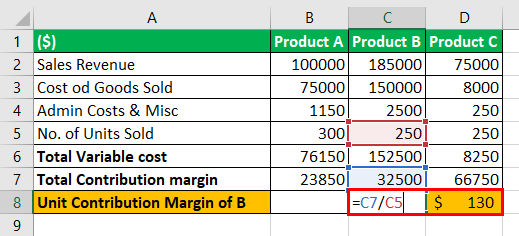

Contribution Analysis Formula Example How To Calculate

The transaction is for a product sale where the direct cost of the product is 50000.

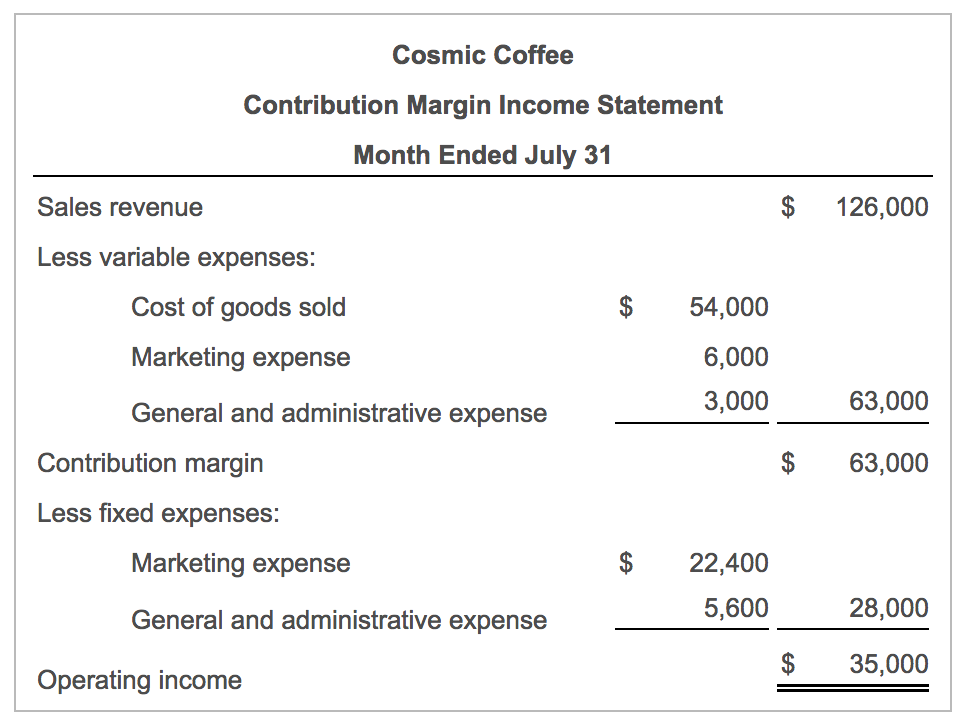

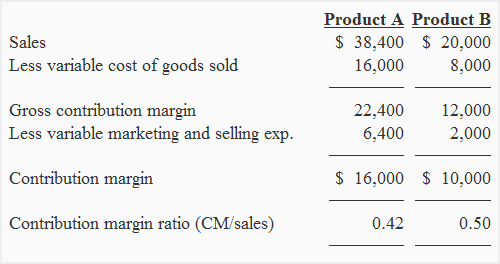

. Thus Contribution Margin Sales Revenue Variable Cost. Contribution Margin Fixed Expenses Net Income. Calculate contribution margin ratio and also express it in percentage form.

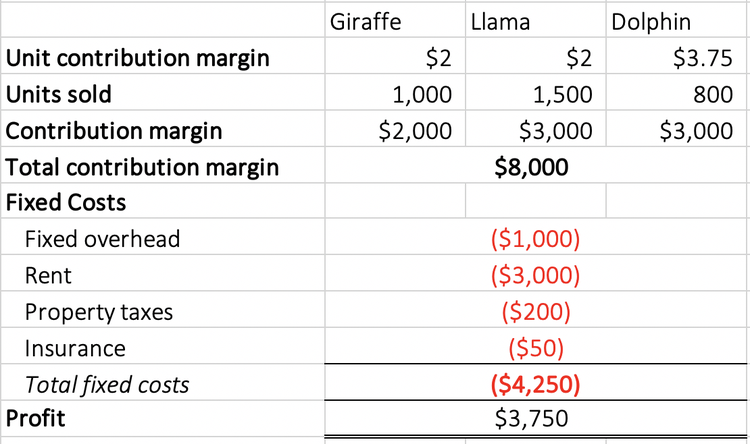

The total contribution margin. The contribution margin is calculated by subtracting all variable costs from sales. The salesman who completed the deal will receive a 2000 commission so the.

Means for any fiscal year the ratio derived by dividing i the Total Product Contribution by ii the Companys net sales for such fiscal year. Companies evaluate their products contribution margins to decide which products to sell using the same manufacturing resources at what price to sell on a per-unit basis or how. Contribution Margin INR 200000 INR 140000.

Contribution margin is used to plan the overall cost and selling price for your. The Contribution Margin represents the revenue from a product minus direct variable costs which results in the incremental profit earned on each unit of product sold. Contribution Margin Fixed Cost Net Income.

In accounting contribution margin is the difference between the sales revenue and the variable costs of a product. It represents how much money can be generated by each unit. We can say that ABC Firm has left over INR.

Contribution margin calculates the profitability for individual. In situations where theres no way we can know the net sales we can use the above formula to find out the contribution. Contribution Margin Net Sales Total Variable Expenses.

Define Product Contribution Margin. Contribution margin is the revenue remaining after subtracting the variable costs that go into producing a product. Contribution margin 150000 60000 30000 150000 90000.

It is an accounting term that helps. Your break-even point is when your cumulative contribution margin exceeds your. Contribution Margin INR 60000.

Contribution Margin Sales Income - Total Variable Costs For variable costs the company pays 4 to manufacture each unit and 2 labor per unit. Contribution margin is a products price minus all associated variable costs resulting in the incremental profit earned for each unit sold. Contribution margin is the portion of a products revenue that exceeds the variable cost of producing that product and generating that revenue.

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

Contribution Margin Ratio Revenue After Variable Costs

How Do I Calculate Gross Margin Smartsims Support Center

Contribution Margin Formula And Ratio Calculator Excel Template

Contribution Margin Formula And Ratio Calculator Excel Template

How Does Gross Margin And Net Margin Differ

What Is Contribution Margin

Solved Linda Fashions Product Line Contribution Margin Chegg Com

Contribution Margin Ratio Formula Per Unit Example Calculation

Contribution Margin What It Is And How To Calculate It

Contribution Margin Ratio Template Download Free Excel Template

Contribution Margin Explained In 200 Words How To Calculate It Cristian A De Nardo

How To Calculate The Unit Contribution Margin

Contribution Margin Ratio Explanation Formula Example Accounting For Management

What Is Contribution Margin How To Find Formula Example Efm

Unit Contribution Margin Meaning Formula How To Calculate

Performing Contribution Margin Analysis Magnimetrics